The Fundamentals of Corporate Voluntary Agreement: What You Need to Know

The Fundamentals of Corporate Voluntary Agreement: What You Need to Know

Blog Article

Ultimate Guide to Recognizing Company Volunteer Arrangements and How They Benefit Organizations

Business Voluntary Contracts (CVAs) have become a strategic tool for companies aiming to navigate financial challenges and restructure their operations. As the company landscape remains to evolve, understanding the intricacies of CVAs and how they can favorably impact business is vital for educated decision-making. what is a cva in business. From offering a lifeline to struggling organizations to promoting a course in the direction of sustainable growth, the benefits of CVAs are multifaceted and customized to address a selection of corporate needs. In this guide, we will discover the nuances of CVAs, losing light on their advantages and the process of application, while additionally delving right into key factors to consider that can make a significant distinction in a company's financial health and future prospects.

Understanding Corporate Voluntary Contracts

In the world of corporate governance, a basic idea that plays a pivotal duty fit the relationship in between companies and stakeholders is the elaborate mechanism of Business Voluntary Contracts. These agreements are voluntary commitments made by business to comply with particular standards, methods, or goals beyond what is lawfully called for. By participating in Company Voluntary Arrangements, companies demonstrate their commitment to social responsibility, sustainability, and honest organization practices.

Benefits of Corporate Voluntary Agreements

Moving from an exploration of Corporate Volunteer Contracts' value, we now turn our focus to the concrete advantages these agreements offer to firms and their stakeholders. One of the key benefits of Corporate Volunteer Contracts is the possibility for firms to reorganize their debts in a much more convenient means.

Moreover, Corporate Volunteer Arrangements can improve the firm's online reputation and partnerships with stakeholders by showing a commitment to dealing with monetary difficulties properly. Generally, Business Volunteer Contracts serve as a tactical tool for companies to navigate monetary obstacles while protecting their partnerships and procedures.

Refine of Applying CVAs

Comprehending the process of applying Corporate Voluntary Agreements is necessary for companies looking for to browse economic obstacles efficiently and sustainably. The initial action in executing a CVA entails assigning a qualified bankruptcy professional that will work closely with the firm to examine its economic situation and feasibility. Throughout the application process, normal communication with lenders and persistent financial monitoring are key to the effective implementation of the CVA and the firm's ultimate monetary recuperation.

Trick Considerations for Companies

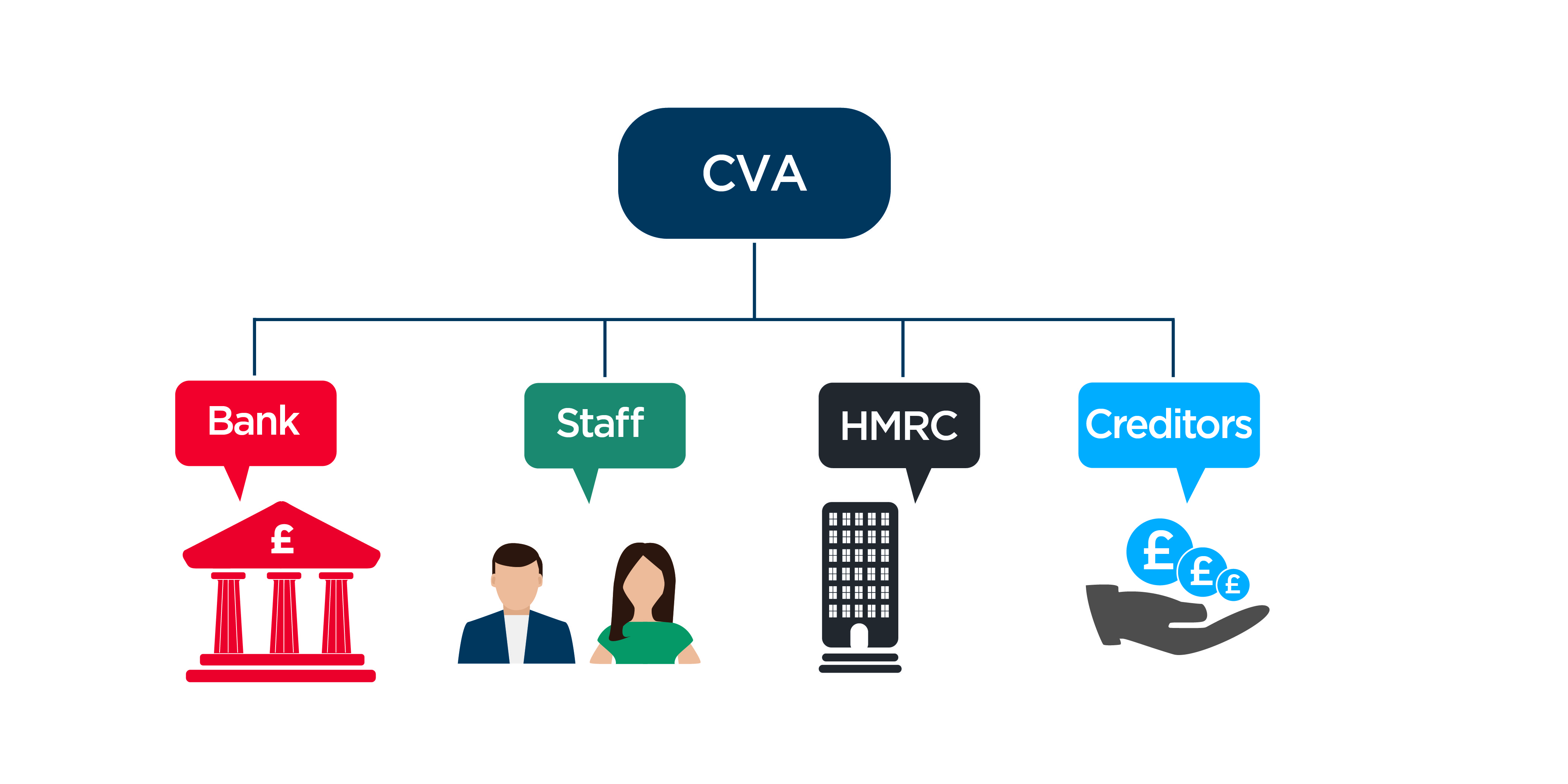

When examining Corporate Volunteer Contracts, companies should meticulously think about vital elements to make sure effective financial restructuring. In addition, businesses ought to thoroughly assess their existing financial obligation structure and review the impact of the CVA on numerous stakeholders, consisting of creditors, distributors, and staff members.

Another essential consideration is the degree of openness and interaction throughout the CVA procedure. Open and straightforward interaction with all stakeholders is important for building trust and guaranteeing a smooth execution of the contract. Services need to also take into consideration looking for specialist suggestions from economic experts or lawful experts to browse the complexities of the CVA process properly.

In addition, organizations need to examine the long-lasting ramifications of the CVA on their credibility and future financing opportunities. While a CVA can provide prompt alleviation, it is important to examine how it may impact relationships with creditors and investors in the future. By meticulously thinking about these essential factors, businesses can make enlightened choices concerning Corporate Voluntary Contracts and set themselves up for a successful economic turn-around.

Success Stories of CVAs at work

A number of companies have actually effectively executed Company Volunteer Agreements, showcasing the performance of this financial restructuring device in renewing their operations. One noteworthy success tale is that of Business X, a struggling retail chain encountering bankruptcy as a result of installing visit the site financial debts and declining sales. By participating in a CVA, Business X had the ability to renegotiate lease contracts with property owners, minimize overhead costs, and restructure its financial obligation commitments. Therefore, the company had the ability to support its monetary position, boost money flow, and prevent insolvency.

In one more circumstances, Firm Y, a manufacturing company burdened with tradition pension plan responsibilities, made use of a CVA to reorganize its pension responsibilities and simplify its operations. Through the CVA process, Business Y attained substantial price savings, improved its competition, and secured long-lasting sustainability.

These success tales highlight just how Company Volunteer Agreements can provide having a hard time organizations with a viable path in visit our website the direction of financial healing and functional turnaround - corporate voluntary agreement. By proactively attending to monetary obstacles and reorganizing commitments, firms can arise more powerful, more agile, and better positioned for future growth

Verdict

To conclude, Corporate Voluntary Contracts provide organizations a structured method to settling monetary difficulties and reorganizing financial obligations. By implementing CVAs, business can prevent bankruptcy, protect their possessions, and keep relationships with lenders. The procedure of applying CVAs entails careful preparation, arrangement, and commitment to meeting agreed-upon terms. Businesses must take into consideration the potential advantages and disadvantages of CVAs before choosing to pursue this option. Overall, CVAs have proven to be reliable in aiding organizations get over look at here economic challenges and attain lasting sustainability.

In the realm of company governance, a basic idea that plays a pivotal duty in shaping the relationship in between business and stakeholders is the elaborate mechanism of Company Volunteer Contracts. By getting in right into Business Volunteer Agreements, firms demonstrate their commitment to social obligation, sustainability, and ethical organization methods.

Relocating from an exploration of Company Voluntary Contracts' relevance, we currently transform our focus to the substantial advantages these arrangements use to companies and their stakeholders.Moreover, Company Voluntary Agreements can enhance the company's reputation and connections with stakeholders by demonstrating a dedication to dealing with economic difficulties sensibly.Understanding the procedure of implementing Business Volunteer Agreements is essential for business looking for to navigate monetary obstacles properly and sustainably.

Report this page